Today, USD-pegged circulating stablecoins account for nearly 185 billion USD market capitalization - a 500% increase from last year. As stablecoin market value surges and financial companies like Visa and Mastercard announce stablecoin integration, the FED decided to research the impact of stablecoins on the traditional markets.

During a time when debates explore whether cryptocurrency is an inflation hedge or a speculative asset class, the Board of Governors of the Federal Reserve published the following research paper in January 2022: Stablecoins: Growth Potential and Impact on Banking. The research investigated the stability of stablecoin pegs, their potential use cases and integration with the fractional reserve model.

It is frequently posited that cryptocurrencies can not provide a healthy economic system because they are too volatile. However, the Federal Reserve is approaching the problem from another angle: How will the financial system adopt cryptocurrencies?

Researchers are exploring whether dollar-pegged stablecoins can be a safe haven in volatile crypto markets during times of distress. The research is also examining the integration of stablecoins with the traditional markets.

Questions for Stablecoin Adoption

- How does the USD peg hold?

- What are stablecoin use cases?

- How will the traditional credit system integrate?

In this article, we will give an overview of these three questions. If you would like to learn more about stablecoins, please visit Introduction to Stablecoins.

There are two main types of stable coins: cash equivalent asset-backed stablecoins and crypto-backed stablecoins.

Cash equivalent backed stablecoins are issued from a legally incorporated firm in exchange for cash or traditional assets like bonds and stocks. Crypto-backed coins are backed by collateralized debt positions or a reserve-backed model.

The peg of a cash equivalent backed stablecoin like USDT or USDC are protected by a firm’s balance sheet. This type is currently the most common and makes up for more than 80% of the stablecoin market. The issuers back the coins through various assets and control the money supply when there is excessive demand during crypto market drawbacks or reimbursement. These coins are also referred to as custodial stablecoins and their reliability has been called into question in the past.

Crypto-backed stablecoins are created with smart contracts that operate on a public ledger. There are two models for crypto backed stable coins: Collateralized debt positions and reserve-backed models.

Collateralized debt positions model, like DAI, are backed by collateralized crypto (such as ETH). In this model, if the collateral ratio goes below a certain level, the position gets liquidated. These types of stablecoins can cause cascading liquidations during high volatility, similar to the March 12, 2020 crash.

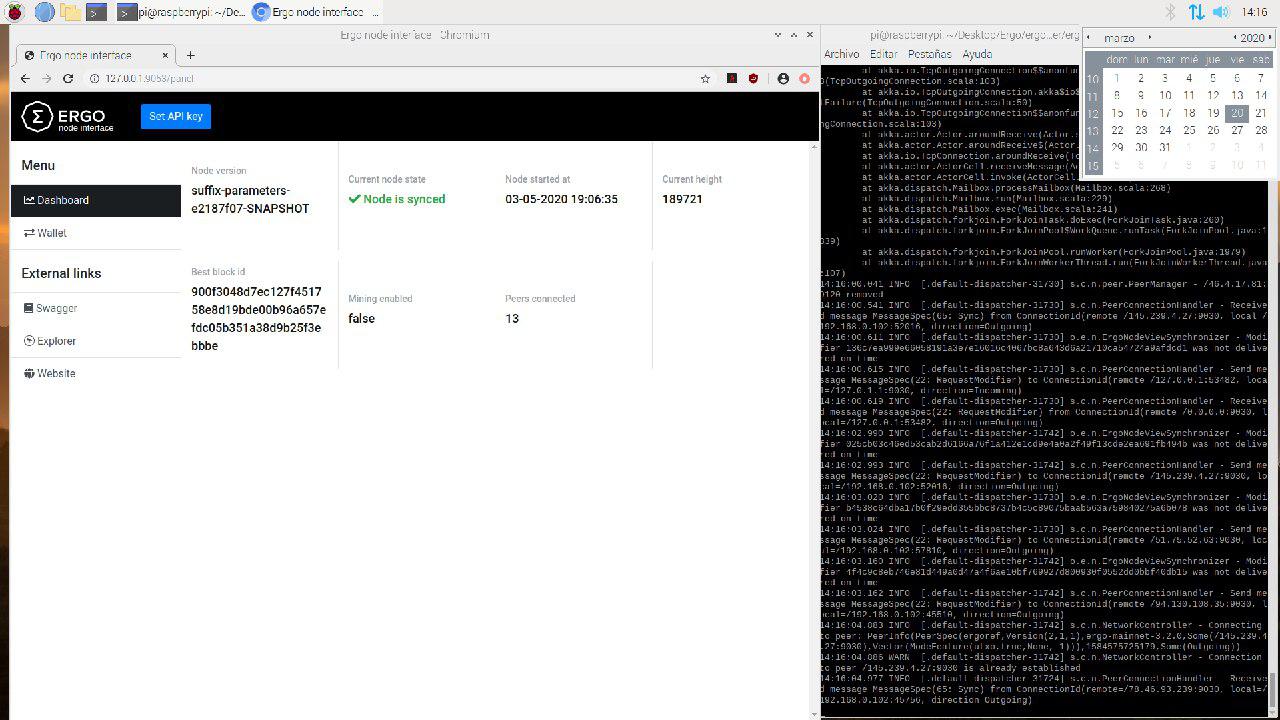

The reserve-backed model is where a certain threshold of reserve coins guard the peg. Ergo’s SigUSD as an example of this: the stablecoin value is protected by locking the contract when the reserve ratio goes below 400%. An excess amount of ERG coins thus protects the reserves.

Stablecoin technology is very new and it has a wide range of use cases that can be applied to many sectors.

The most important use of stablecoins is for making lightspeed cross-border transactions without passing through intermediaries. This means that people can use stablecoins at all times throughout the year on a public blockchain with instant settlements and minimal fees.

Stablecoins are pegged to a fiat currency, and they provide nonvolatile cryptocurrency alternatives for new crypto enthusiasts. They facilitate peer to peer transfers, cross border payments and online commerce. Institutions can use these coins for cheap internal transfers and more transparent liquidity management. In decentralized finance, the programmability aspect of stablecoins makes it suitable to integrate into a variety of financial instruments such as market-making protocols, lending protocols and derivatives.

Because of their current ambiguous status in the regulatory landscape, not all aspects of stablecoin use cases have been fully explored. In the future, one might expect to see stablecoin innovations in areas such as micropayments, tokenized assets, and Web3 integration.

Tokenization of real-world assets can increase circulation and accessibility by leading to an integration between decentralized and traditional finance. Such ease of access encourages participation, especially in asset classes like real estate, by allowing worldwide fractional ownership secured by decentralized servers.

Social media platform integration can benefit content creators by directly providing revenue from their contributors instead of relying on advertisement companies. For example, instead of relying on Youtube revenues, a Web 3 wallet integration can facilitate direct earnings from viewers.

Lastly, in this section, we will look at the integration of stablecoins with traditional banking models.

The FED research focuses on cash equivalent-backed stablecoins and not decentralized stablecoins. This is because DeFi stablecoins currently make up about 15% of the total stablecoin market cap and are still a relatively experimental area compared to centrally issued cash and asset-backed stablecoins.

In most scenarios credit provision will remain unaffected. Furthermore, stablecoin issuance will likely increase the liquidity by replacing banknotes.

Narrow Bank: This type is mostly neutral as it refers to 1-to-1 backed stablecoin reserves with central bank currency equivalents. The fractional reserve banking system will not be used as stablecoins will be the tokenized equivalents of fiat.

Two-Tiered intermediation: Stablecoin issuances will be carried out by commercial banks so that the peg will be protected in a fashion that is similar to today’s fractional reserve system. Commercial banks will be able to loan out the reserves and circulate stablecoins into the economy.

Security Holdings: Stablecoin issuance will be carried out by depositing stocks and bonds. Therefore, the need for cash will greatly diminish as there will not be a need to hold it. However, as they might be backed by risky assets, deposit protection can be negatively affected.

In contrast to the narrow bank framework, a two-tiered system can support a functioning and stable economy. However, the Security Holdings model will increase the risk of the fault of reimbursement during volatile periods because securities are mostly less liquid than cash equivalents.

As dollar-pegged stablecoins function as a safe haven during crypto market volatility, FED research explains how the traditional economy can embody the stablecoins on a large scale.

Lately, we see increasing momentum towards centralization as more than 30% worth of DAI is also backed by USDCs. Stablecoin protocols are usually governed by governance token holders, therefore it will be up to people to decide how much these stablecoins will be decentralized.

Decentralized Stablecoins on Ergo

The SigUSD stablecoin on the Ergo Platform is backed by SigRSV tokens. SigRSV tokens are minted with ERG, therefore the value of SigUSD is pegged to 1 USD by an excess reserve of ERG. Below the 400% threshold, SigRSV redeeming stops to protect the SigUSD value.

The ErgoDEX team is currently developing the Dexy stablecoin protocol which will work through the collateralized debt positions model. In this model, the value of the stablecoin will be protected by liquidating the collateral positions when the reserve ratio drops below certain levels.

Decentralized stablecoins are an important feature of decentralized finance ecosystems. They are fast, immutable and accessible for all of us. However, as usage increases and ecosystems merge into one another, decentralization and protection limits will be reinterpreted. New people and new institutions joining smart contract ecosystems will probably have a choice of multiple stablecoins for various platforms.

Conclusion

Cryptocurrencies are still regarded as a risky asset class, however the market capitalization of stablecoins has increased fivefold during the last year. The Board of Governors of the Federal Reserve System are taking this issue seriously and have started researching the integration of stablecoins into traditional markets. Decentralized stablecoins still take up only a small percentage of the market compared to centrally issued asset-backed stablecoins. However, decentralized stablecoins can now also be issued by collateralizing centralized stablecoins. Integration of coins like USDT and USDC into decentralized exchanges like ErgoDEX will inevitably lead to the intersection of these two sectors and encourage faster integration of DeFi markets.