You can vote for ErgoDEX in Project Catalyst Fund 5

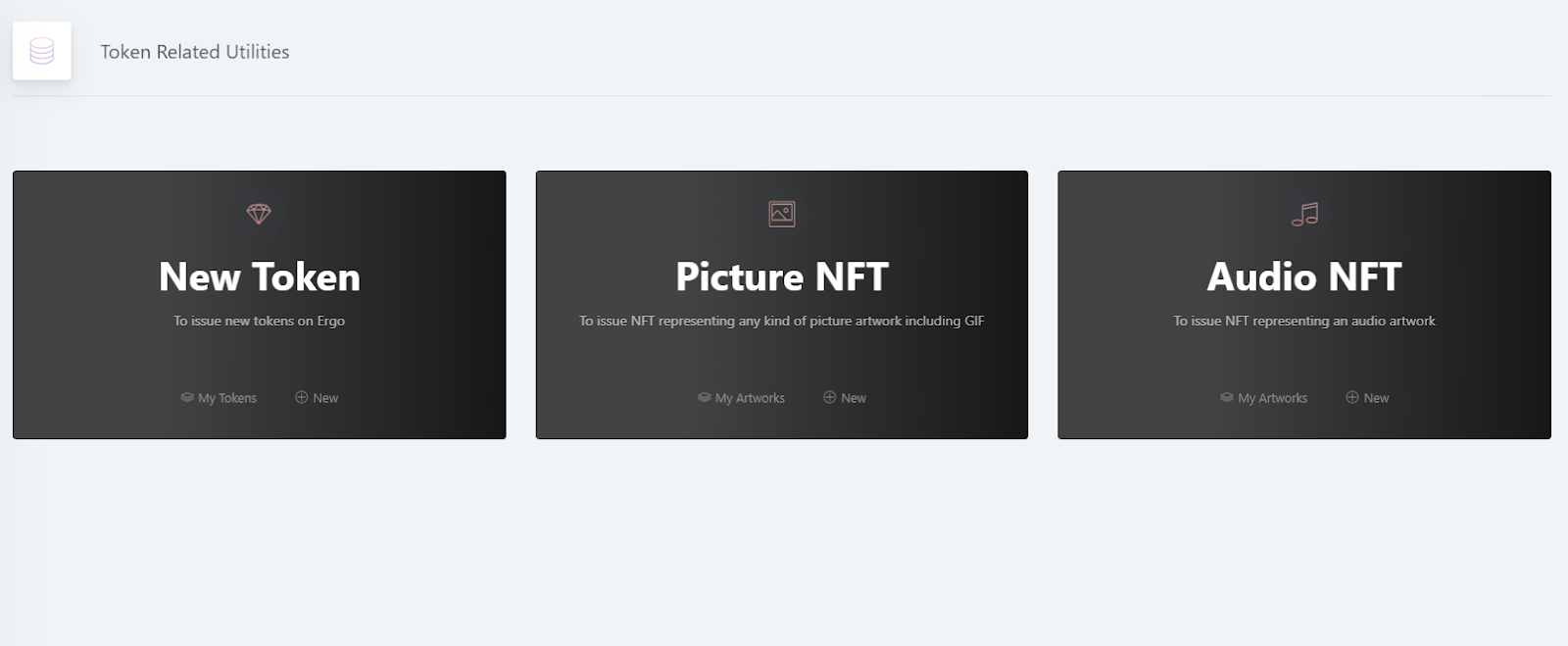

Within a few weeks, Ergonauts will witness the highly anticipated debut of Ergo’s decentralized exchange: ErgoDEX. A decentralized exchange (DEX) allows users to trade assets and provide liquidity through the execution of smart contracts - there is no need for any intermediary. Ergo’s PoW (Proof of Work) consensus utilizes the eUTXO model (extended unspent transaction output) when performing transactions. With its use of Σ-protocols (a type of zero knowledge proof), Ergo smart contracts are highly efficient and secure with features such as ring-signatures, multi-signatures, multiple currencies, advanced privacy and self-replicating scripts.

Before diving in any further, it might help to discuss terminology that may be unfamiliar to some readers.

Automated Market Maker (AMM) - AMM’s enable users to commit trades through smart contracts. These smart contracts provide a trustless environment where algorithms execute the trades from liquidity pools. An AMM also incentivizes participants to provide token liquidity for transactions on the exchange.

Order Book - This type of trading tool allows users to list buy/sell prices for different trading pairs. When a trader lists a price they are willing to buy/sell at, it is called a limit order. An order remains open until cancelled or another user agrees to buy/sell at the price listed. Users who are familiar with centralized exchanges like Coinbase and Binance will recognize this type of order book.

Atomic Swap - This type of exchange allows users to connect their wallets to do straight swaps between different tokens via the DEX.

In order to get a better understanding of how ErgoDEX will be situated in the DEX market, it helps to take a look at pre-existing DEX’s. Those who are familiar with the crypto industry have probably heard of Uniswap, Pancakeswap and Mdex. These DEX’s exist and operate on several different chains: Uniswap on Ethereum (ETH), PancakeSwap on Binance Smart Chain (BSC), and Mdex on Huobi Eco Chain (HECO) and BSC.

Uniswap offers an AMM and the ability to swap ERC-20 tokens but since the transactions happen on the ETH network, costs can rise with gas fees. PancakeSwap and Mdex also offer AMM’s but there are serious concerns about the centralization of BSC. Of these three DEX’s, Mdex is the only to offer cross chain interoperability.

ErgoDEX will be a signature dApp in the Ergo ecosystem, offering secure and efficient cross chain liquidity and interoperability on both the Ergo and Cardano networks. Through the eUTXO model, ErgoDEX will also allow for shared liquidity between the various exchanges on top of the two blockchains. Users will have the option of an AMM, Order Book and/or Swap function while also having the opportunity to earn incentives when providing liquidity on ErgoDEX. The DEXes we discussed earlier offer only some of these functions. With ErgoDEX, users will have access to a fully decentralized cross chain DEX without needing to worry about their privacy or high transaction fees (such as gas fees).

There are several other DEX projects being developed for deployment on the Cardano network, but none offer all the combined features that ErgoDEX promises. With Ergo’s Σ-protocols and NIPoPoWs operating as dynamic tools in the design and implementation of ErgoDEX, we may be looking at the new standard in the DEX market.

For an overview of the roadmap and development team, visit ergodex.io