Bitcoin is often thought of as an anonymous currency used by criminals and hackers. While this myth has been dispelled many times, it still lingers on. The truth is that Bitcoin is a pseudonymous cryptocurrency. While no names or real identities are tied to addresses and transactions, these can all be seen through the public ledger that is the blockchain.

While the alphanumeric wallet addresses do not give away any private information, there are ways in which these can be connected to real-world identities, including wallet transaction broadcasters who can link your address to an IP, and especially fiat on and off-ramps.

Blockchain: A Problem Or The Solution?

When one uses a centralized exchange to buy or sell crypto for fiat, they’ll have to go through a KYC (Know Your Customer) process, which will reveal their identity. In some aspects, Bitcoin and other public blockchains are not suitable for money laundering and other malicious activities . Criminals will still need to go through regulated corporations to cash out any ill-gotten funds or spend them on any real-world items.

In short, Bitcoin is actually a much better alternative when it comes to anti-money laundry enforcement when compared to private banking or cold hard cash. So much so, former CIA Acting Director Mitchell Morell revealed that cryptocurrencies between made up to less than 1% of all illicit financial activities between 2017 and 2020. In this report, he mentions that illicit activities with fiat money count for an astonishing 2 to 4% of the U.S.A.’s GDP.

Privacy and User Security

On the other hand, pseudo-anonymity makes users vulnerable to malicious actors.When receiving a payment, users need to share their public wallet address which exposes the wallet, the transaction and the funds to the entire world which make high-network individuals a target for wary hackers and criminals.

A random spy actor can monitors wallets and transactions, and they can devise an attack plan if any security flaws are discovered. This becomes even more dangerous when one considers the potential for data leaks on exchanges or third-party wallets, which may allow nefarious actors to link a wallet to an I.D., social security number, and more.

The public and pseudonymous nature of blockchain comes as a double-edged sword. It makes the users vulnerable to attacks, leaks, and other issues. Traditionally, banks and governments keep their centralized ledgers private, which means one must trust the aforementioned entities to remain honest and ensure the safety and liquidity of funds.

Money For The People

Call for action! As I said earlier, money laundering schemes were around before Bitcoin and even now they take up as much as 1% of total usage in crypto. When regulators are keeping a close eye on the public ledger, with the help of KYC exchanges, they can still know what you’re up to. In a way, you may think that’s okay because governments must prevent black money circulation to stop illegal activities. We think that’s okay too! However, up until now, they were closely following personal bank accounts and the only thing they prevented was individual users from freely using their funds. Big corporations can continue walking around legislation to evade taxes and bad actors use global money laundering schemes to continue using black money. What governments do is keeping a close eye on citizens by seeing them as potential money launderers. How does this sound?

Bitcoin FUD(Fear, Uncertainty, Doubt) arguments made by regulators were mainly counting on the idea of Bitcoin as a private, anonymous, uncontrollable, and unstoppable money. We know that these cases aren’t true, we saw that cash was the primary money laundering tool and blockchain wallets are traceable. When you withdraw your money to your bank account, governments know what were you doing with your non-custodial wallet. The only case is then, you’re in control of your own funds, and you aren’t using “legal” fiat money controlled by central banks. That makes governments powerless on a global state because they can’t tell you what you should do with your funds or they can’t ban your account when they spot an unexpected activity.

What remains is that they can question you about where did you get the money that you withdrew to your central bank account to pay your bills and make shopping etc. Also, they can’t ban your account, for example, when you didn’t pay your debts but let me ask again: Did these powers stop illicit financial activities, or prevent big players from taking delirious debts and going bankrupt? The answer is no, illicit financial activities continue happening elsewhere and institutions can rely on the “too big to fail” argument with the hope of bail-outs when they need them.

Enhancing Privacy and Anonymity

For the protection of individuals, we have private chains or ‘CoinJoin’ (coinmixer) apps that make users' wallets untraceable. Like I said this doesn’t mean that a user can launder money because every on-chain financial activity must end with an “integration” phase, which means withdrawing funds to the real, off-chain world. If you can prove that the custody of your funds wasn’t involved in any illicit financial activity, you shouldn’t be prevented from using privacy-enhancing tools to protect yourself in the on-chain world. You hold your keys, you hold your coins or in a reverse phrase- not your keys, not your coins. That also includes custodial exchange wallets because in centralized exchanges this is not any different from using a bank. You aren’t in crypto if you use only centralized exchanges, they can track you, prevent you or on the worst scale they can steal your coins(exit scams).

That’s why decentralized finance protocols are entering their golden era now. You don’t have to give up the custody of your funds to use financial applications. Decentralized exchanges are becoming more efficient and cross-chain operations are becoming stronger by supporting all cryptosphere with a single non-custodial wallet. Coin mixing services don’t rely on custodial firms, they are working on zero-knowledge proofs. Decentralized applications are shining in a traditionally controlled government-backed finance world. A new history is upon us and we are just seeing the tip of the iceberg. Future is very exciting in this sense: Banking the bankless with decentralized applications, giving power to the people, draining seigniorage rights of governments and preventing bail-outs of “too-big-to-fail” institutions by infinite money printing -or how is it called in the fancy financial literature- by quantitative easing.

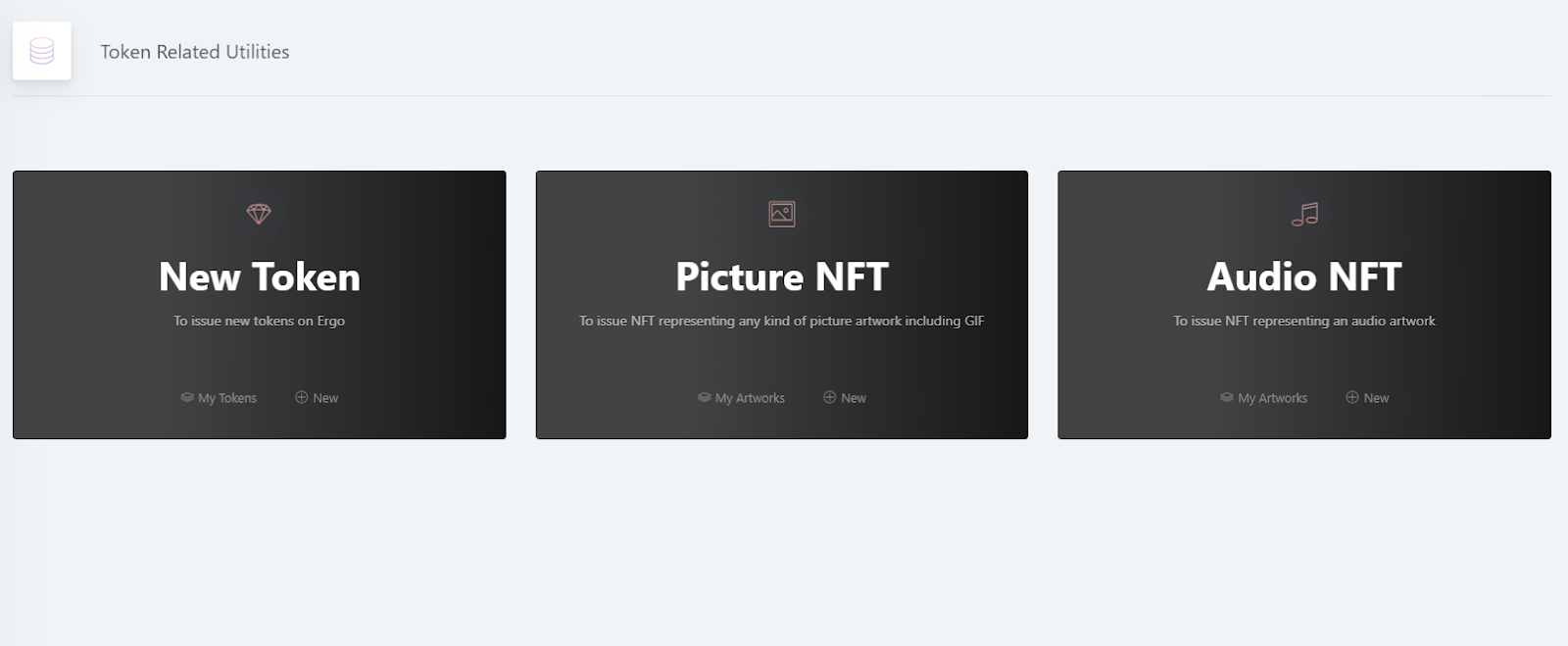

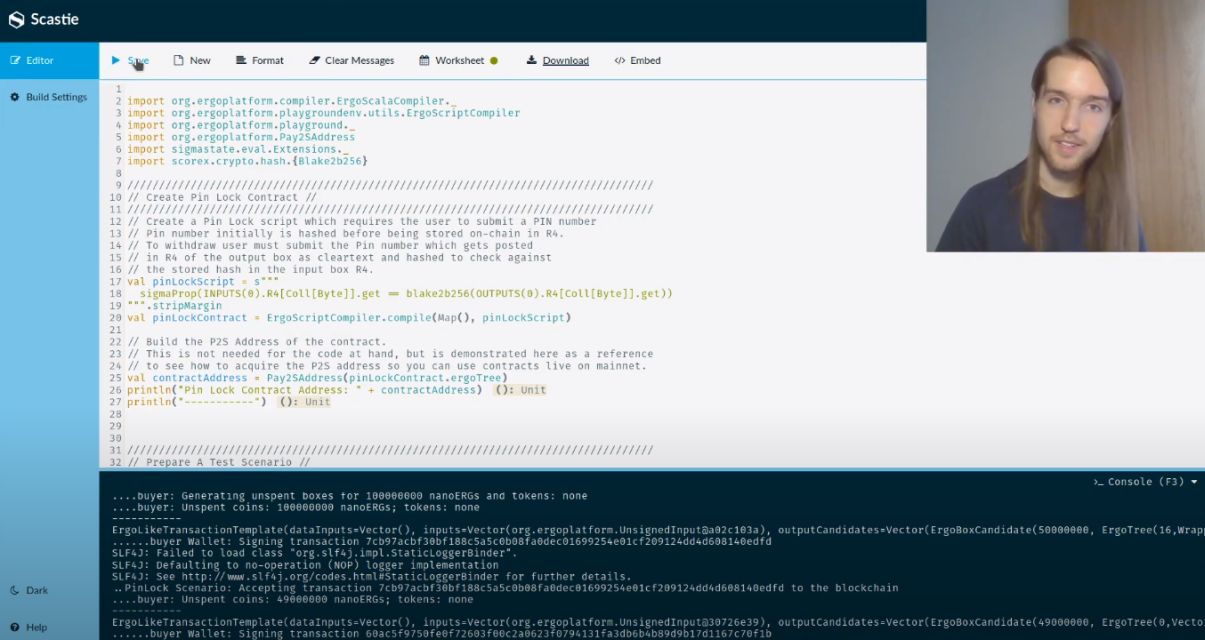

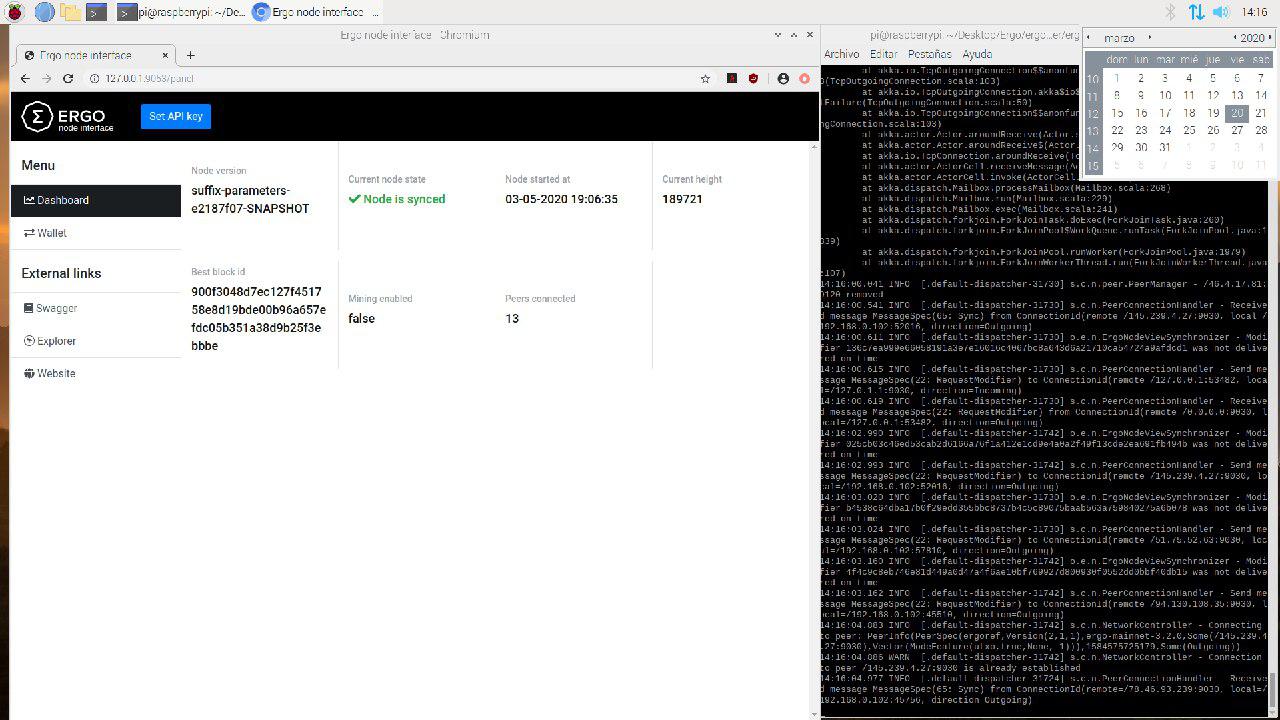

Ergo Blockchain provides a non-custodial coinjoin service, the ErgoMixer, as a dApp. It basically protects you from spy agents in the blockchain sphere. It is perfectly secure with its open-source code so that you know what you are interacting with. For more, Ergo Blockchain is a powerful network and it supports Layer 2 services on top of it so anyone can create private side-chains to use blockchain securely. We will provide more updates on the exact details of ErgoMixer later on and new developments on Layer 2 services and privacy focused dApps will soon flourish with new developers coming on board.

Ergo Blockchain isn’t built for governments or institutions, it’s built for people by the people.