The Ergo Manifesto hopes to educate and offer a vision of what blockchain technology can achieve. We hope to build society through horizontal cooperation through production under the division of labor, trade and exchange, and solidarity and mutual aid.

We believe this is achievable while maintaining basic principles that benefit the well-being of all humans. Core principles that have been central to human rights and values must be maintained as our technological capacities evolve. The built tools must enrich human value rather than subjugate humans in systems of surveillance and control.

By Kushti- With Help From the Ergo Team

A lot of blockchain-related news these days is saying that a bank X or a corporation Y will use a “blockchain” to “reduce costs”.

This is just another buzzword considered by big banksters as another tool to extract value from everywhere in a more efficient way and save on cutting job positions.

What I witnessed in the early years around online forums users is this,

Cryptocurrency should provide tools to enrich ordinary people. Small businesses that are struggling to make ends meet, not big depersonalized financial capital. This is what inspired me. This is my dream.

In the eyes of the original broad community vision, the tools of a cryptocurrency should allow people to do economic activity whatever the business size, geographic location, or interest rates set by big players.

The tools should allow people to make contracts (digital, self-enforcing, reasonable smart contracts) regardless of the differences in jurisdictions, traditions, followed business practices, etc.

I hope Ergo will be helpful here. Thousands of small cooperatives and individual entrepreneurs are much more critical to healthy and sustainable wealth growth around the globe compared to a couple of corporations hiding profits in offshore heavens.

Let’s consider the use and integration with communities, cooperative federations, nonprofit foundations, and philanthropic trusts.

Let’s try to create grassroots finance.

Yes, many other things can be built, but I think my goal should not be forgotten. Smart contracts that help create value and protect the common people.

Bitcoin Origins

The first Bitcoin block (known as the Genesis block) contained a message stating, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

The creator of Bitcoin and inventor of the first working blockchain chose to conceal his identity through a pseudonym that we’ve all grown accustomed to, Satoshi Nakamoto.

This block timestamped both the inception of Bitcoin and the start of an era of technological and financial innovation. Simply put, this was the catalyst for a full-blown revolution.

Decentralization is political. It gave birth to the idea that monopolized powers could be replaced by technology. Systems could be put in place to transfer value globally without the need for intermediaries or oversight.

People could choose the currency they use and determine who, how and when they could exchange value with one another.

An entire industry formed around the idea of P2P commerce. Open, borderless and secure channels could potentially prove mechanisms to level the economic playing field and provide tools for prosperity for the average citizen of earth.

Current Market Mindset

The mentality of crypto markets shifted considerably after the ICO mania of 2017. It seems that the space as a whole has come to celebrate bailouts, printing, and stimulus.

Yes, there have been some massive price gains in fiat and much hype-based marketing, but it seems the original intent of goals of cypherpunks is becoming increasingly diluted.

This is something that needs to be addressed. If cryptocurrency is to be implemented as an effective tool for the average human, we need tooling and adoption. Right now, it seems the market mentality is as follows: how do we honeypot new users with hype marketing, drive pumps and cannibalize these new members of communities.

The current state of the market is a little sad. We need to get back to the roots of the crypto-revolution, decentralized tools that are private, secure and drive real-world adoption of these systems. The ideal is to create tools that help people create value.

Why is this important?

The global economy has not improved since the original bailouts. I understand that the central narrative around privacy and security always plays on emotional extremes; however, the reality is it is always the ordinary humans that get burned when economies implode.

Think about it for a second.

Corporations have access to foreign markets and foreign credit. They have many tools to adjust and circumvent economic difficulties.

As for criminal enterprises, they generally benefit from economic hardship. Hard times drive self-medication. Larger criminal syndicates are essentially import/export businesses. They also have access to foreign currency and often run black-market currency exchanges and further leverage this international access for profit.

Terrorist organizations benefit during times of economic hardship. Nothing motivates a person towards violence like righteous anger from a sense of being trapped and hopeless. Terrorist organizations thrive in regions of chaos. They feed on chaos; it is their single greatest tool of recruitment.

The wealthy in our world often have internationally allocated portfolios. They are relatively liquid and generally have the ability to circumvent difficulties through market access, regulatory means such as tax havens, loopholes, and jurisdictional arbitrage.

There are multiple examples of economies that are in severe distress, one that made news recently was Turkey. The Turkish Central Banks recently banned cryptocurrencies as a form of payment. They cut access to a potential tool that would benefit the average citizen.

The foreign exchange rate of the Lira to the dollar in 2010 was 1.14. The current exchange rate is 8.50. That is an 86.5882% decrease in purchasing power.

Imagine you are a Turk; perhaps you have traded a lifetime of time and labor to earn and save. In the span of a little over a decade, over 86% of your monetary value has disappeared.

The sad thing is that blockchain was accessible in Turkey; however, the custodial actors abused their position.

It is critically important to make systems as non-interactive and non-custodial as possible. Eliminating the potential for bad actors and protecting the people. This was a failure in technology and should serve as a warning to the dangers of centralized blockchain.

Let this serve not as an example of why blockchain is terrible but why ordinary people need truly decentralized tools that they can trust.

Like in most jurisdictions on earth, the average citizen of every country has essentially zero power over monetary policy. The average citizen lacks the tools that corporations, criminal organizations, terrorist organizations, and the wealthy have to protect themselves and benefit from financial difficulties. Financial circumstances were created by the same powers that now hold their wealth hostage.

The reality is that the people at the top always get the life raft when a boat sinks, the people at the bottom go down with the ship. Now, this is not unique to Turkey. This is currently a global phenomenon. It is apparent looking at the changes in the distribution of wealth. However, it has been sanitized to seem more palatable. It is not the wealthy who have life rafts, and the ordinary people are drowning.

It is a K Shaped economic recovery.

The Weaponization of Money

Centralized programmable digital money sounds like an efficient technical upgrade to the existing monetary infrastructure. In some areas, this may be the case. However, it appears that the basic constructs of money are in the beginning stages of an era that will further weaponize money against the average human. Current fiat-based monetary systems attack ordinary citizens by creating persistent inflationary pressures.

This is the direct result of central bank printing, monetary intervention, and mismanagement of fiscal budgets by central governments.

The resulting monetary policy has inflicted great hardship on the average global citizen by perpetually driving up the cost of living. Hyper Monetization has transformed nearly every asset class into a financial instrument that is used as a means to generate wealth. This has driven wealth inequality globally and produced inflation of global debt to levels never seen in recorded history.

The truth is that many consumers have been led to believe larger numbers automatically equate to greater wealth. The reality is that currency is decreasing in its purchasing power. Your house did not double in value; your currency purchases half as much house. Wage inflation has yet to equalize the inflationary pressures put on the middle and lower classes globally. The result is a further increase in personal debt and monetary stress on the average consumer.

As central banks begin to enact a shift to Central Bank Digital Currencies, they may end up redefining the historical principles of the currency itself. I fear that money will be weaponized and turned into a tool of social control.

I believe three particular points need to be watched for and rejected to prevent the adoption of weaponized money.

The first is programmable money’s ability to have an expiration date and or the ability of central powers to burn CBDC forcibly. This constitutes theft to the highest degree. Perhaps we will hear some sanitized terms, such as digital asset forfeiture; however, this level of centralized power will forever alter the balance of power between citizens and the state.

The second is the ability for centralized power to connect credit or payment ability to a citizen’s social status within a community. Simply stated, this is weaponizing money against dissent. The ability for a citizen to dissent in any free society is generally the only legal means they have to effect change. Absent the ability to dissent; society is not free. Connecting centralized access, reward mechanisms, or conformity to digital money currency is weaponizing money against thought, freedom of speech and freedom of expression.

The third aspect of digital money to watch is the ability to censor or limit credit in particular market areas. This challenges the sovereignty of money itself. The collective social contract has generally been that your money is yours. It is your property, your asset. Restricting or limiting consumers' access to spending their wealth is a power we must all fear and resist. Although legalization has prevented access to specific markets, products and services, cash has remained sovereign. This pillar of freedom must be respected. This potentially could destroy the concept of a free market.

Privacy

Privacy must remain an option to protect the individual. It does not have to be forced; let people make their own choices.

Privacy is the ability to create barriers and erect boundaries to create a space and for the individual. It is up to each what borders and boundaries they choose to make.

Civilization exists under a continuous tension between what is best for society and what is best for the individual. The only real entities in a community are individuals. All collectives, associations, and governments stem from individual participation and interaction.

Privacy protects the individual from society.

Privacy creates space to allow personal autonomy. Personal autonomy is the basis of individual rights.

Privacy, both financial and personal, is a critical component of life in a free society. When in the wrong hands, personal information can be wielded as a powerful tool of control and manipulation. Privacy allows individuals to make decisions free of coercion.

Individuals in free societies must have a boundary, a private reality, free of government involvement, surveillance, and control. Current technological trends in our world significantly intrude on one’s personal space.

Individuals should have control over who has access to information about their personal and financial lives.

Privacy is a matter of trust. The lack of privacy demonstrates a lack of confidence. A lack of trust cannot be the foundation of a healthy society. Healthy societies are built on cooperation. Voluntary cooperation is, in and of itself, an exercise in trust.

Privacy rights mean that groups can’t take your data without your knowledge/consent and leverage this information for their benefit.

Financial privacy is especially vital because it can be the difference between survival and systematic suppression of an opposition group in a country with an authoritarian government. Absent privacy, individuals in society have no means of survival when under the threat of oppressive regimes.

How many times in human history have religious, political, or tribal conflicts lead to one group in power forcibly taking the wealth of another less powerful group? How often is the seizing of financial assets used as means of authoritarian control?

Many businesses, dissidents, and human rights groups maintain accounts outside the countries where they are active for precisely this reason.

Financial privacy can allow people to protect their life savings when a government tries to confiscate its citizens' wealth, whether for political, ethnic, religious or “merely” economic reasons. Financial privacy is of deep and abiding importance to freedom, and many governments have shown themselves willing to abuse private financial information.

Ergo.nomic Money

The goal of the Ergo blockchain is to create Ergonomic Money.

Ergonomics is the scientific discipline concerned with understanding the interactions among humans and other elements of a system and the profession that applies theory, principles, data, and methods to design to optimize human well-being and overall system performance.

Time and time again, economies implode, those with financial tools end up cannibalizing the wealth and value of the ordinary people. This is not ergonomic; it is predatory and monopolistic. We need better tools.

Now perhaps competition will upset central powers. It certainly did in the case of Turkey. That is why these tools need to be private, resilient, censorship-resistant, secure, open and free.

Perhaps you live in a developed society and think it is fine; the central banks are pumping liquidity into our economy. Central banks are bailing enough water that the ship won’t sink. I hope you are right, but I fear you are wrong.

Simply because the tools we are building may not benefit you today, make no mistake, they may be the lifeboat of tomorrow. That is the intent, purpose of my life’s work in cryptocurrency.

Anyone who dares to say cryptocurrency is just a tool for criminals' and terrorists' need to search how these organizations are funded, protected and where they draw their supply chains from before making such accusations. Ignorance is venomous.

It is often those at the bottom who suffer in separation from those at the top who initiate the suffering. This cycle of economic abuse needs to be broken.

The goal of Ergonomic money is to create money and smart contracts for all people. Those at the bottom have the greatest need for the type of tooling we are building.

Ergo Basic Principles

In this section, we define the main principles that should be followed to create ergonomic money.

This might be referred to as “Ergo’s Social Contract”.

In case of intentional violation of any of these principles, the resulting protocol should not be called Ergo.

- Decentralization First

Ergo should be as decentralized as possible. Always strive to spread and grow. Any party’s social leaders, software developers, hardware manufacturers, miners, funds need to avoid central points of failure. All actors whose absence will disrupt the system’s function need to have contingency plans in the event of a disruption. Decentralization is born from education and adoption. The tools we build need documentation; the community needs to participate and grow actively. Teach others to use and adapt the tools. The internet is a powerful driver of decentralization, and it can be a powerful tool to teach. Decentralization is born from education, both on the development side and the user side.

Malicious behavior that may affect the security of the network should be avoided. If any of these parties appear during Ergo’s lifetime, the community should consider ways to decrease their impact level. There will always be those who seek to disrupt, take advantage, misuse and abuse their power. What is the answer? Education. Educating users to protect themselves, identify malicious actors, avoid them, and work together to minimize their influence. I would encourage all community members to continually seek to learn, adopt tooling, assist and teach in one way or another. A strong community is born through strong cooperation. - Open Permissionless and Secure

Ergo protocol does not restrict or limit any categories of usage. This is necessary to remain resilient. We certainly can advocate cooperation, trade, and human values; however, we do not enforce them. That would require a central power. Developers are free to implement any logic they want, taking full responsibility for the ethics and legality of their application.

All code for the core protocol must remain fully open and transparent. Every line should be fully auditable and transparent. This prevents manipulation as well as builds decentralized resiliency. Ergo is fully committed to being open source to remain trusted, and that trust must remain fully verifiable.

Anyone can join the network and participate in the protocol without permission. Unlike the traditional financial system, no bailouts, blacklists, or other forms of discrimination should be possible on the core level of Ergo protocol. Insider advantage should be minimized.

Ergo is committed to supporting privacy tools for those that wish to use them. This must remain a voluntary choice if a user wants to use mechanisms to disrupt the public availability of their data entirely within the scope of their power. They must take full responsibility for the ethics and legality of these actions.

Ergo is committed to best security practices. This is a continual commitment to prevent network attacks, preserve privacy and protect on-chain value. - Created for Regular People

Ergo is committed to being a tool for Regular People. Ergo is a platform for ordinary people, and their interests should not be infringed upon in favor of big parties. In particular, this means that the centralization of mining should be prevented. Regular people should be able to participate in the protocol by running a full node and mining blocks. Post Autolykos V1 Ergo will work to provide a hash rate distribution of pools.

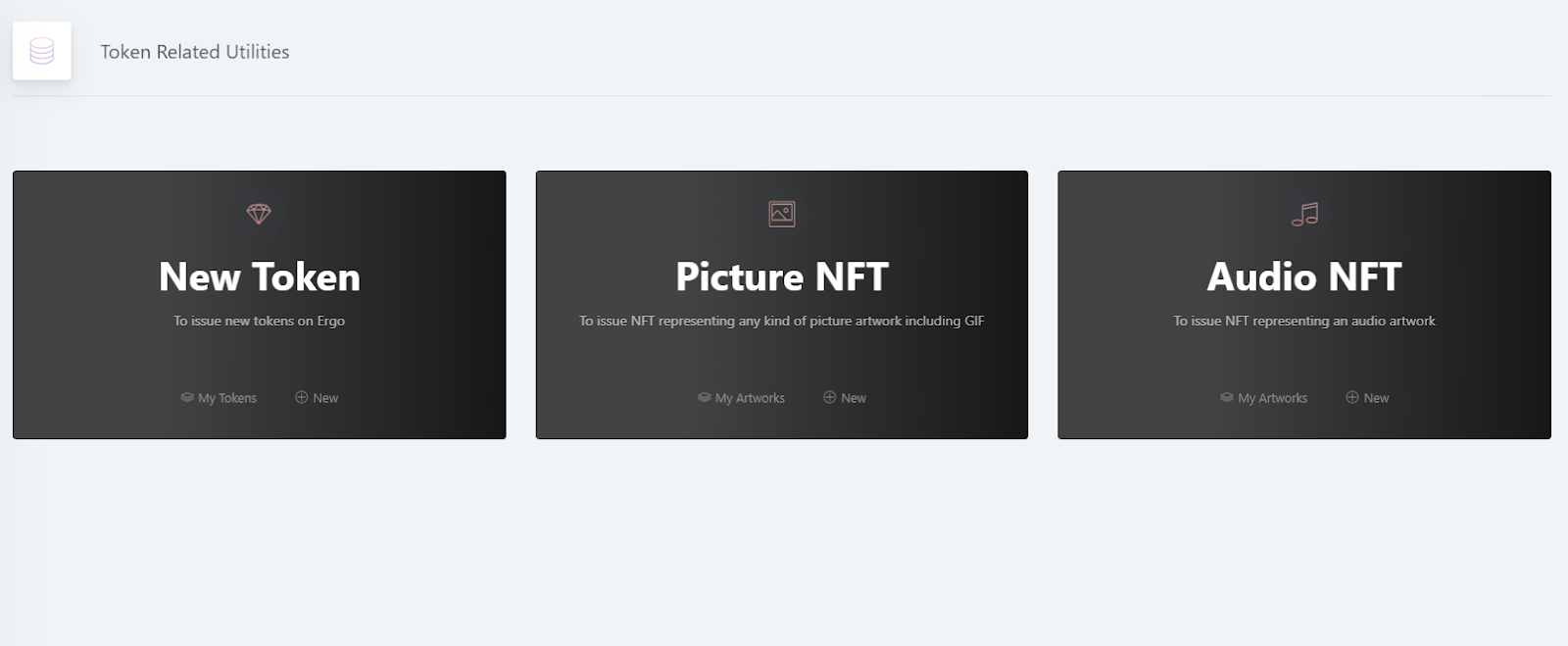

Ergo is committed to building an ecosystem that offers tools designed to assist regular people. Peer to peer exchange is continually under threat from peer to central power exchange. It is Ergo’s goal to encourage tooling and community education to empower ordinary people. - A Platform for Contractual Money

Ergo is the base layer to applications that will be built on top of it. It is suitable for several applications, but its main focus is to provide an efficient, secure and easy way to implement financial contracts. Ergo is committed to building a network on solid foundations that continue to update and innovate. The goal with contractual money is to create a system that is not overrun by high user costs and fees. For money to be Ergonomic, it must remain cost-competitive. Ergo will assist with frameworks and tooling for people to build and implement to maximize the use and utility or contractual money. - Long-term Focus

All aspects of Ergo development should be focused on a long-term perspective. Ergo was launched in crypto winter; the purpose and intent of Ergo core developers need to supersede short term market conditions. There will always be those who come for short term appreciation and those who come for the principle.

Smart contracts for the people is an open-source concept to provide a system that can empower the average person. That goal is to remain resilient, adaptable and secure through the long ark of time.

Since Ergo is designed as a platform, applications built on top of Ergo should also survive in the long term. This resiliency and long term survivability may also enable Ergo to be a good store of value and a mechanism to assist the ordinary human.

We should always see beyond our noses, thinking into the future. What tools can we add? How can we improve? What are the risks? How can we prepare for what is next?

This long term vision must never die for Ergo to survive. Ergo was born in crypto winter when many had already begun dismissing the future of distributed systems and their ability to create value; nonetheless, we endured, kept building.

Too often, people sacrifice long term growth for short term excitement. Good times will come, and hard times will come. If Ergo is to endure, we must be principled and create value on solid foundations.

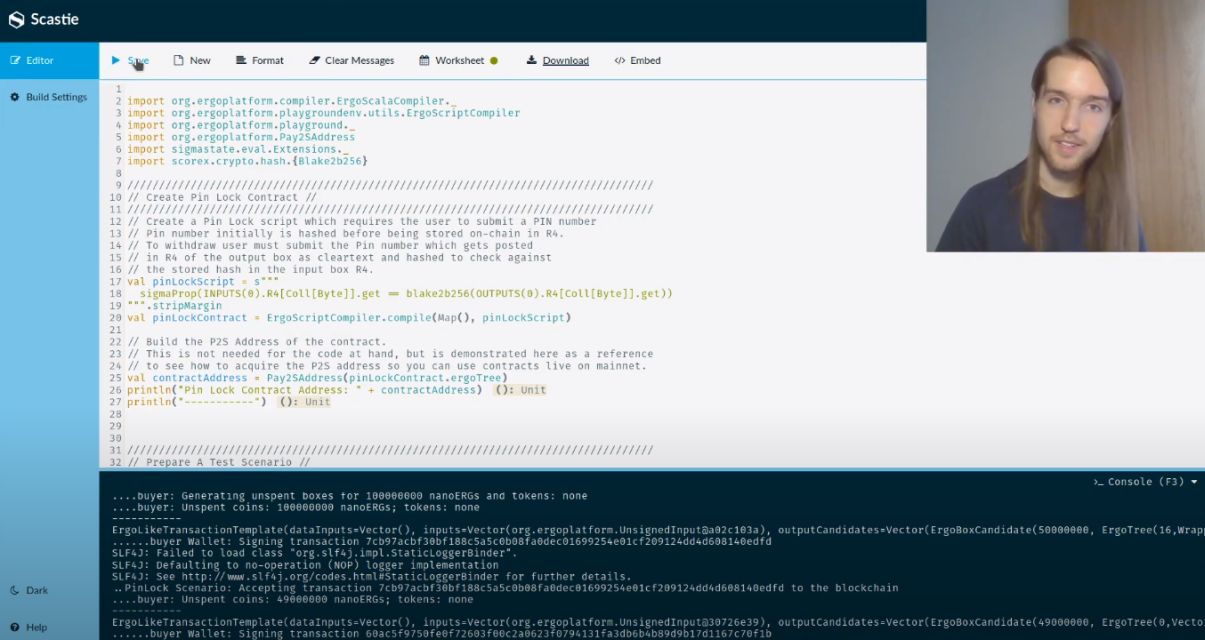

Who is Kushti?

Alexander Chepurnoy (aka Kushti) is the core developer of Ergo Platform, and he has been active in blockchain development and smart contracts since 2011. He was a core developer for NXT, started smartcontract.com(now Chainlink) in 2014 with Sergey Nazarov, and is an IOHK researcher with over 20 academic papers to his name. When working on Nxt, he started the ‘utterly simple blockchain framework’ Scorex, which was later pivoted into a modular blockchain framework. This project got attention from Charles Hoskinson, Cardano and Ethereum co-founder, around mid-Autumn 2015. Then he joined IOHK around January' 2016.

A Note On Token Economics:

Ergo Platform had a fair launch in the very beginning. It didn’t hold any ICO, and there weren’t any pre-mined coins for the platform’s founders. Decentralization and fairness of a peer to peer monetary system was the priority in the first place. Foundation treasury is set to %4.37 of the total coins mined, and it isn’t possible to change the core elements of token economics further.