At the risk of stating the obvious, decentralisation is the hallmark of DeFi. It is decentralisation that brings the benefits of transparency, accessibility, security, immutability, composability, efficiency and more besides to these new financial initiatives.

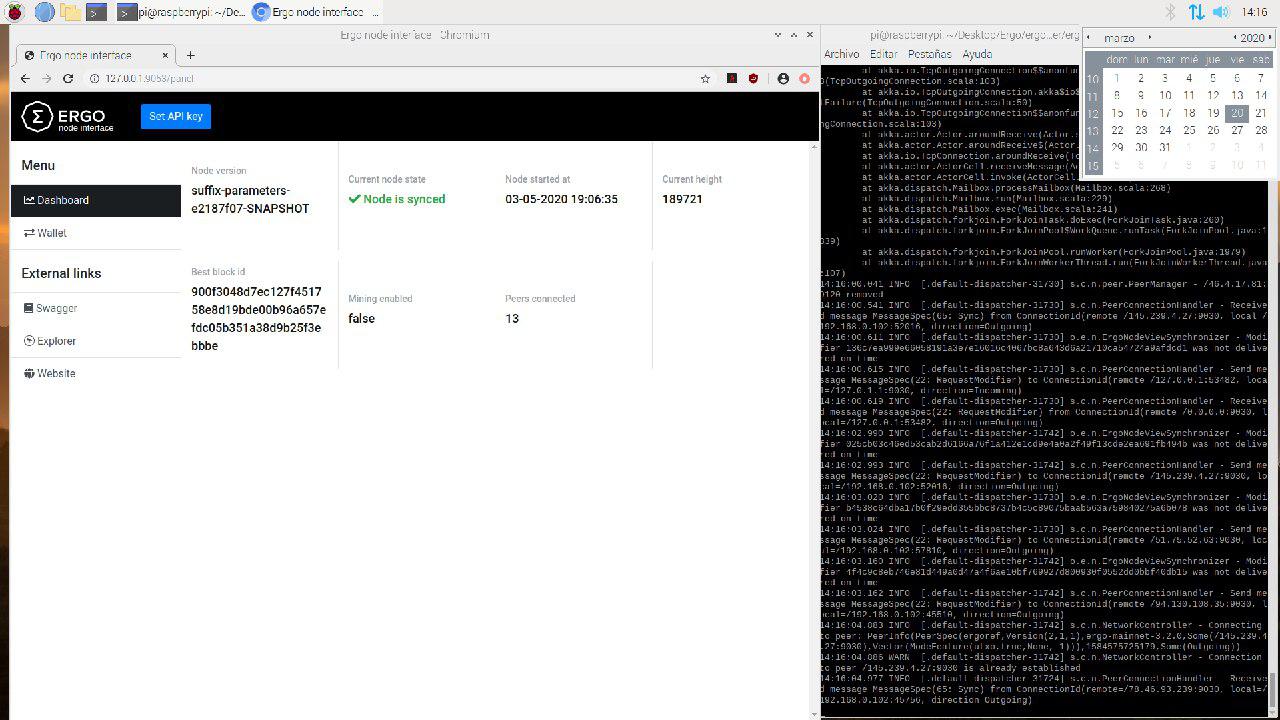

As a DeFi platform that aims to take and build on the best features of Bitcoin, Ergo is committed to decentralisation.

And so it is with a mixture of interest, concern, excitement, dismay and, frankly, awe that we watch the current DeFi craze for Yield Farming unfold. A $10 billion movement has arisen almost overnight.

As the number of DeFi initiatives has multiplied, and with them yield farming opportunities, we have seen Ethereum struggle under the volume of transactions. A simple ETH transfer can cost several dollars, a token transaction $10-20. The kind of complex transactions associated with smart contract execution for DeFi protocols can be many times that.

This hardly fulfills DeFi’s promise of providing universal access to financial services. So what are we to make of this?

Decentralisation comes first

There’s some exceptional innovation in the DeFi space, but equally, it’s easy to be critical of some of the recent DeFi initiatives: protocols that have been built (or cloned) for the sole purpose of capitalising on the yield farming craze, with no real-world utility, ability to generate revenues, or expectation of longevity. In one sense, it’s little more than a rerun of the altcoin craze of 2014-15. It’s certainly not what Ethereum’s founders had in mind. Vitalik Buterin has compared yield farming protocols (unfavourably) to central banks in their need to constantly print more tokens to sustain themselves.

The problem is that no one gets to say how an open platform ‘should’ be used – even its creators. The nature of decentralisation is that no one has control. Open platforms are like democracy: in the words of Winston Churchill, the worst system, apart from all the others. Or, to quote William Gibson’s sci-fi short story, Burning Chrome: ‘The street finds its own uses for things’. Put a piece of tech in the wild, and you shouldn’t be surprised if users come up with applications you never expected. Yield farming is just another result of DeFi’s core characteristics of openness and composability.

Viewed this way, yield farming isn’t a ‘good’ or ‘bad’ application of blockchain. It just is. It’s what the street, or the crypto community, has decided to do with DeFi.

The opportunity

There’s precedent for such an unintended development. Bitcoin was launched as peer-to-peer digital cash. It ultimately became digital gold, a hedge against inflation in a world in which the money printers were running hotter than an overclocked mining rig. Bitcoin survived and even thrived on its new narrative; it turns out the street valued digital gold more than it valued digital cash.

For initiatives that aim to impact the mainstream, like Ergo and many other DeFi applications and platforms, yield farming might be an unwelcome reality. Right now, it’s preventing regular users from accessing DeFi and realising the benefits we hoped to make available to our users. But to take action – even if that were possible – would be to make blockchain and DeFi something that they are not. The only way to do that is to exert some form of control and centralisation.

Instead, we have to treat this as an opportunity. There may be damaging consequences in the long run, just like the Silk Road, a major use case for bitcoin, brought unwanted scrutiny and adverse reputation for the idea of digital money. But if DeFi truly is decentralised – the property that makes yield farming possible – then it will survive, albeit not in the form we first expected or hoped. More than that, it will thrive. Understood this way, yield farming is an uncomfortable test of DeFi’s robustness. Better now than later, when it has gained real traction.

The attention brought to DeFi by yield farming may not be there forever, but it’s there now. We have work to do to enable DeFi to operate at scale, but we had to do that anyway. Yield farming has also brought new users, new technology, and new liquidity.

There are worse problems to have.