Overview

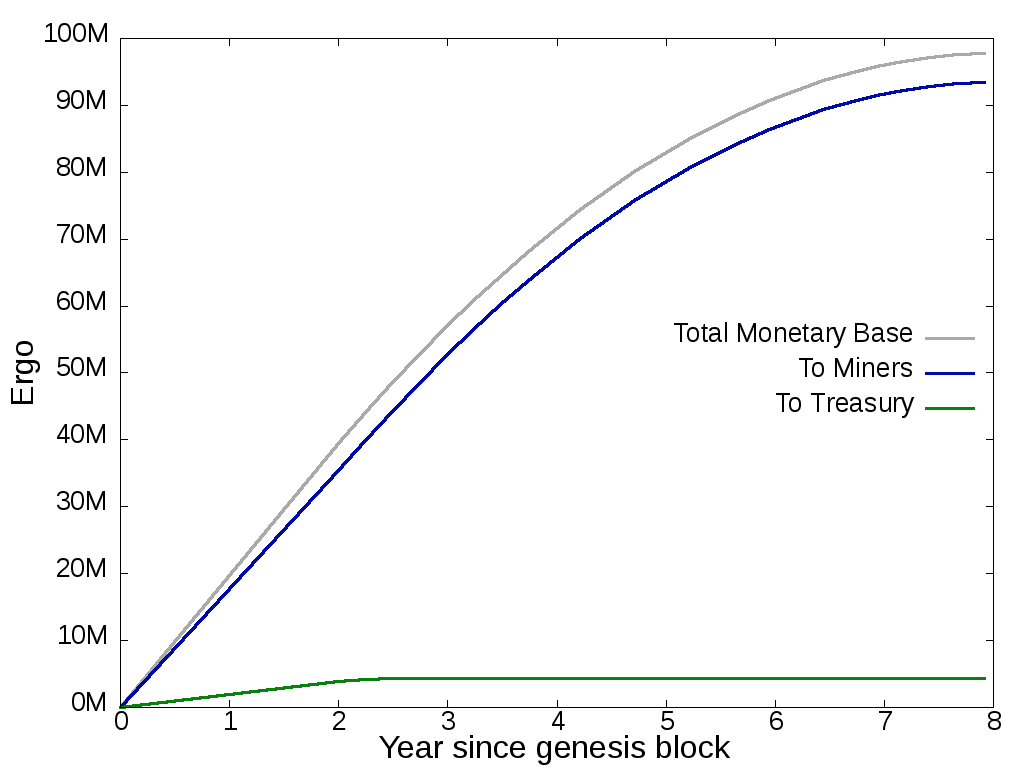

Ergo’s native token is called Erg and its emission schedule may be of keen interest to users and miners of the platform. Ergs also have some unique characteristics which are highlighted in this post. Most basically and leaving out technical details, Ergo has a strictly limited supply, an 8‐year emission schedule and a declining rate of emission over these 8 years. All tokens are mined through an original Asic and Pool‐resistant Proof‐of‐Work (“PoW”) algorithm called Autolykos. Therefore, there are 0 Ergs in existence at launch of mainnet as there was no ICO nor pre‐mine. At the end of 8 years, the final Erg supply will be 97,739,925 Ergs. The Ergo block interval is 2 minutes and for the first 2 years, each block will release a total of 75 Ergs to be shared between the miners and the Treasury (Treasury discussed below). But starting at year 2, the rate of emission will fall by 3.0 Ergs and thereafter further decline every 3 months by an additional 3.0 Ergs, which will result in an end to emission 8 years after launch. There will be no additional inflation and the Erg monetary base will remain fixed. The Emission Chart below illustrates this.

The Ergo Treasury

To fund development, promotion, events, to swap Ergo’s Ergo First Year Tokens (“EFYT”, further discussed below) into Ergs and to fund other activities which may advance the platform, Ergo has in place a Treasury which will receive 4.43% of the Ergs released during emission. During the first 2 years post‐mainnet launch, the Treasury will receive 7.5 Ergs per block. Given that the block reward for each block is 75 Ergs total, the Treasury’s allocation of Ergs is equivalent to 10% of the total block reward over the first 2 years and leaves miners with a block reward of 67.5 Ergs per block. After 2 years, the Treasury will continue to receive the part of the block reward that exceeds 67.5 Erg, however, this will be 0 after year 2.5 when the block reward becomes 66 Ergs per block. Readers familiar with some other PoW protocols with a Treasury, such as ZCash, may find this to be similar, however, it should be noted that the amount of Ergs going to the Treasury comprise a total of only 4,330,791.5, or 4.43% of the total monetary base, and is completed in just 2.5 years. This compares with ZCash’s Treasury, which was 10% of the ZCash total monetary base and 20% of all issued ZCash coins during the first 4 years. With Ergo, it is hoped that by 1 year post‐mainnet launch, Ergo will have achieved a high level of decentralization with a diverse developer, miner and user base. For the first year, the Treasury will be used for swapping of the EFYT on the Waves platform for Erg. For the remaining 1.5 years, a community voting mechanism will be put in place to determine how Treasury funds are spent.

The Ergo Emission Chart and Code

The code for the emission schedule can be found here

The Ergo First Year Token (“EFYT”)

EFYT was airdropped and distributed on Waves DEX starting with a 100,000 EFYT airdrop 2 years ago in May, 2017. EFYT served the dual purposes of helping to build an early community of stake holders and enthusiasts for Ergo and of raising a small amount of funds for the platform before launch to fund development, promotion etc. EFYT is strictly a Waves token and is not the same as an Erg, which is the Ergo mainnet native token mined after Ergo’s mainnet launch.

EFYT will be swapped with a fraction of the Ergs mined within the first 1 year post mainnet launch. The planned mechanism for executing the swap is first, a new payment gateway will be set up on Waves for Ergo’s mainnet token, Erg. More on Waves payment gateways can be found here. After the gateway is set up, as the Ergo Treasury receives Ergs from the mining reward, the Treasury will deposit these Ergs to Waves via the gateway, at which time, the Treasury will make a bid in the market at fixed price of 1.00 ERG / 1.00 EFYT and owners of EFYT can then swap their EFYTs for Ergs and do as they wish with their Ergs including holding them on Waves, trading on Waves or transferring their Ergs out of Waves via the gateway to their own wallet for use elsewhere. All EFYT purchased by the Treasury in this process will be burned.

The current distribution of EFYT can be found here. It should be noted that the max supply of EFYT is 1,970,945.0. This is 10% of the first year of Ergo token emission and the same number of Ergs that the Treasury will receive, meaning that the Treasury will have received 1,970,945.0 Ergs during year 1, sufficient to swap the max supply of EFYT for Erg.

How can Ergo Issue the Entire Erg Supply in only 8 years whereas other PoW blockchains all have much longer emission schedules?

Other than Ergo, few, if any, PoW protocols have such a short emission schedule as 8 years and it is worth mentioning what makes this possible for Ergo. Firstly, to briefly compare with just a few prominent PoW and recently issued PoW tokens, Erg supply is 100% issued after 8 years, with no long tail of emission, whereas emission of:

- Bitcoin is approximately 75% issued after 8 years with a long tail of emission to follow;

- ZCash and Ravencoin follow the same emission schedule as Bitcoin;

- Beam will be 75% issued after 8 years and has a long tail of emission;

- Grin inflation extends out indefinitely

Ergo’s short emission schedule is made possible through its new economic model, namely, the storage rent fee component of its protocol. Miners will have an additional source of income and a paper on that is available here. In summary, miners are able to deduct a storage rent fee every 4 years denominated in Erg from an unspent box (similar to a UTXO in Bitcoin) in exchange for the cost of keeping such box in state which resides in high cost memory. Therefore, miners will be highly incentivized to secure the network even in the absence of a block reward subsidy and this will lead to a more stable mining reward than just relying on transaction fees alone which miners will also receive. Other benefits from having the storage rent fee include prevention of “state bloat”, building of an economy around state (users must pay to keep unspent boxes in miners’ memory for the long‐term) and a gradual return of any lost coins back into circulation. Note that in Ergo, miners can use on‐chain voting to gradually change many key parameters including the storage rent fee, block size and maximum computational cost of a block.